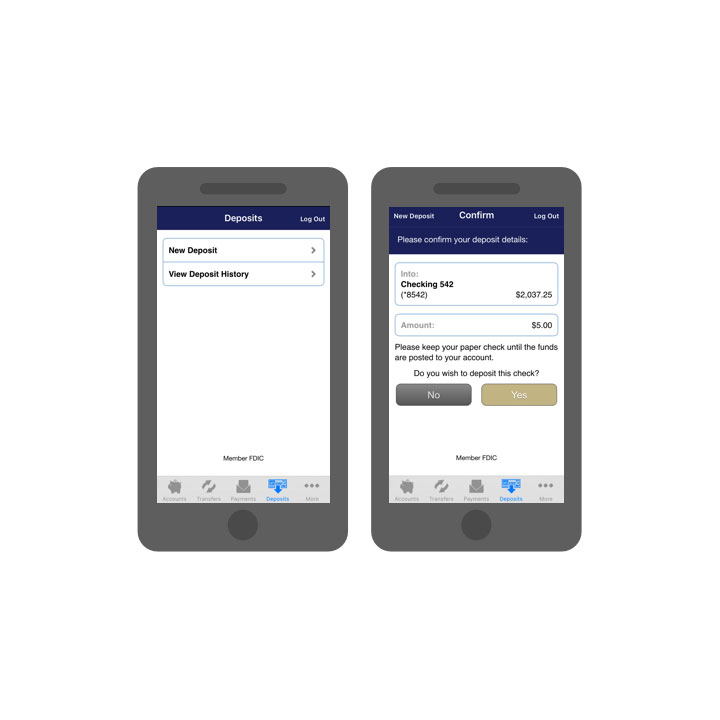

InterBank’s Mobile Deposit feature available in the mobile app allows you to deposit a check using your camera-equipped smartphone. Just use the InterBank App to take a photo of both sides of the check, then follow the on-screen instructions to deposit it into your account.

To apply, please read the agreement and complete the enrollment form below. Please allow up to 2 business days for the enrollment form to be processed. You will receive an email from InterBank with your Mobile Deposit status. Service availability and mobile carrier fees may apply.